How To Get A House With Bad Credit

Buying a house with bad credit — or, more accurately, a low credit score — can be challenging, but it's not impossible.

Purchasing a home requires having money for a down payment, a solid history of paying your bills over at least the past year or two and a steady income. You'll also need to meet the lender's minimum credit score requirements. While higher credit scores earn more favorable loan terms, it's still possible to buy a home with bad credit.

What is the lowest credit score to buy a house?

Credit scores from 500 to 579: Theoretically, you can qualify for a mortgage with a credit score as low as 500, but you'll be limited to a loan insured by the Federal Housing Administration. With a credit score from 500 to 579, you'll need a down payment of at least 10% for an FHA loan . The lender will want you to pay off any outstanding collections and judgments.

Credit scores from 580 to 619: You might qualify for an FHA loan with a down payment as low as 3.5%. Or, if you are eligible, you could qualify for a VA loan — a mortgage guaranteed by the Department of Veterans Affairs.

Credit scores of 620 to 699: Your mortgage opportunities increase. You may qualify for a conventional loan, which isn't backed by a government agency like the FHA or VA, with a minimum credit score of 620.

Credit scores of 700 and up: Lenders are more willing to extend credit when you have a credit score from 700 to 739, and a score of 740 or higher will yield the lowest interest rates.

Nerdy tip: Many people lost their jobs or had reductions in income in the recession that accompanied the COVID-19 pandemic. As a result, mortgage lenders became more cautious. Some raised the minimum credit scores for applicants. You may have to shop around even more than usual to find a lender willing to accept low credit scores.

Knowing and improving your credit

As a potential homebuyer, it's important to reduce debt, accumulate as much cash as you can and review your credit history. Knowing your creditworthiness is an essential step in buying a home with bad credit. To find out, examine your credit report and check your credit score.

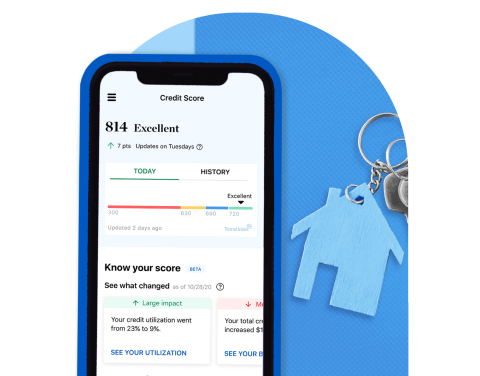

The smart home for your credit

NerdWallet tracks your credit score and shows you ways to build it — for free.

There are a variety of places you can find your credit report, including personal finance websites like NerdWallet, the financial institution where you bank and the government-mandated website annualcreditreport.com.

Check your reports for errors. Look for accounts that haven't been updated correctly or anything else that doesn't accurately reflect your true credit history. If you do find errors or inaccuracies, you can dispute them with the credit bureaus or the creditor reporting the information.

Clean up your credit history. Making on-time payments may help your credit score. And a better credit score can lift your chances of getting a more affordable home loan.

Your free credit reports won't include your credit scores. To see scores for mortgages, you can purchase a full report from myFICO.com. The most economical approach is to sign up, download the first month's information, then cancel the service before the next billing cycle.

How To Get A House With Bad Credit

Source: https://www.nerdwallet.com/article/mortgages/buy-a-house-bad-credit

Posted by: billerovertaker.blogspot.com

0 Response to "How To Get A House With Bad Credit"

Post a Comment